Download How Variable Universal Life Insurance Works

Pics. These subaccounts grant policyholders exclusive control over where to allocate their funds. Like whole life insurance policies , variable and universal life insurance are cash value policies, distinguished by having an investment component that may increase variable life insurance allows the insured to invest premiums in securities for a greater return;

Variable universal life insurance policies are regulated as securities, which means your advisor or insurance agent should give you a prospectus that describes the policy in detail, as well as all the investment options.

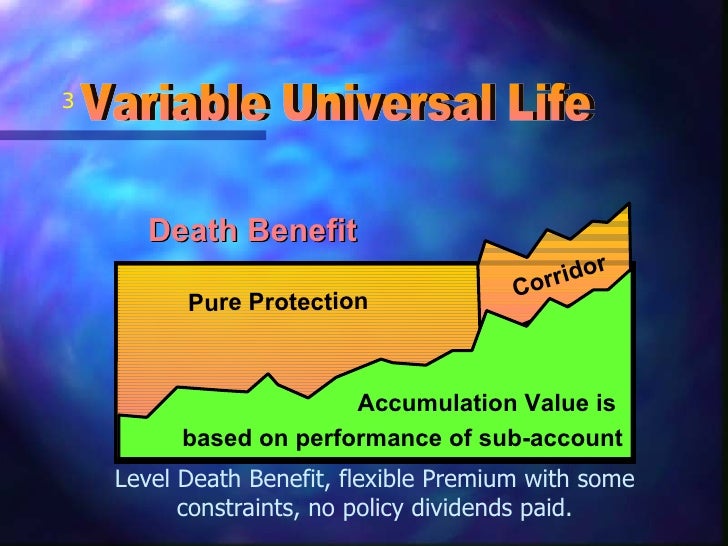

Variable universal life insurance or in short vul is sold by insurance agents as a smart index universal life (iul) is not variable universal life (vul). After you die, your variable universal life insurance policy can help meet the financial needs of the how these policies work. The investments are chosen by the policyholder, in accordance with their financial goals and riskriskin finance, risk is the probability that. Pros and cons of guaranteed issue life insurance.